Trading in financial markets is done in different ways, and traders choose different trading strategies, depending on the type of market and their risk tolerance. One of these strategies is news trade time or trading during news. Stay with us in the future, we will review the trading strategy of Khabar Trade Time.

What is the news about Trade Time?

News trading time refers to a strategy in which traders buy and sell assets when important economic or political news is released. The popularity of this trading method is due to the extreme fluctuations of the market at the time of announcing the news; Because rapid changes and price fluctuations in the market can create many profitable opportunities. However, due to the high risk of news trade time and unpredictable market reactions, trading in news time requires accuracy, experience and quick market analysis.

What is the difference between news trade time and normal trades?

News trade time and regular trades are both methods of profiting from the financial markets, but there are fundamental differences between them. In the following, we will examine these differences so that you have a better understanding of these two methods.

Basis for decision making; News analysis versus technical and fundamental analysis

In normal trades, traders usually use technical and fundamental analysis tools for their trading decisions. But on the other hand, the basis for deciding to enter and exit trades in news trading time is real-time analysis and quick reaction to news. The purpose of this type of analysis is to exploit the sharp and short-term fluctuations of the market after the release of important news.

Market fluctuations

The trading time of the news is associated with strong and rapid fluctuations of the market, because at the time of the release of important economic and political news, there are many emotional and sudden reactions in the market. Asset prices may change significantly within minutes. In contrast, normal trades are usually done in markets with less volatility, where price changes are more gradual and traders make decisions based on technical and fundamental analysis.

Timing and speed of reaction

In regular trades, traders usually have more time to make decisions and analyze. They can carefully follow price trends and buy and sell assets more calmly. But in the trade time of news, the speed of reaction is very important. Traders must make a decision within a few minutes or seconds as soon as the news is published, and any delay can lead to losing the opportunity to profit or incurring losses.

Risks and capital management

The trading time of the news carries a lot of risks due to the extreme fluctuations of the market when the news is released. The market may not move contrary to initial predictions or may react unexpectedly to the news. Capital management in this type of transactions is very challenging and requires caution and strict compliance with risk management rules. In normal trades, however, trading risk is usually more predictable and traders can control their trades better by using risk management tools.

Emotions and mental stress

Traders are under more pressure during the news trade time, because they have to make quick and accurate decisions; Any small mistake in analysis or delay in execution of trades can lead to huge losses. But in regular trades, there is less pressure on the traders because there is more opportunity for traders to study the market and make rational decisions.

Why is news trading time attractive for traders?

Khabar trade time is attractive to some traders for several reasons. In the following, we will examine each of these cases.

Profitable opportunities

Because of the high volatility at the time of news release, traders can take advantage of the quick and short-term price movements in the market to make a profit. These large price movements at the time of news release can mean achieving higher profits in a shorter period of time than normal market conditions. Also, if leverage is used, you can make more transactions with less capital and multiply your profit. Of course, by using leverage, the risk of your transactions will multiply and you should use it with caution.

high excitement

One of the reasons for the popularity of Khabar trade time for traders is its high excitement, which is caused by the extreme and unpredictable fluctuations of the market at these moments. The publication of important economic and political news quickly shakes the financial markets and asset prices change suddenly. These rapid fluctuations create a tense atmosphere in the market, which is very exciting for traders.

Increasing experience and skills in transactions

Khabar Tradetime provides a challenging environment for traders that leads to rapid growth and upgrading of their skills. The extreme and unpredictable fluctuations of the market in these times force traders to make quick decisions, perform their analyzes very carefully, and manage risk management and capital management well. Also, experiencing these conditions in the market helps traders to strengthen their emotional control in the financial markets and make more rational decisions.

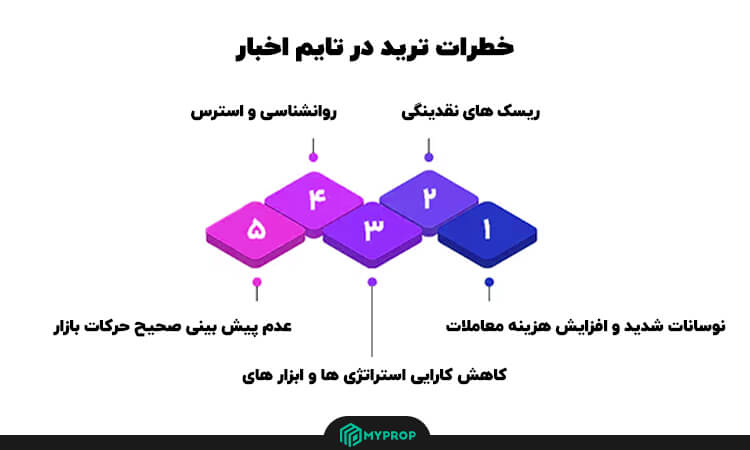

Risks of trading in news time

As we said, trading during news releases in financial markets can be very risky. In the following, we will examine some of the most important risks and challenges of trading in the time of news.

-

Extreme fluctuations and increased transaction costs

- Sudden price movements: When an important news such as economic reports, changes in interest rates, central bank statements or news of political events is announced, financial markets react quickly and suddenly. These fluctuations may be unpredictable and uncontrollable.

- The possibility of slippage: Slippage in transactions, when the news is released, means the execution of an order at a price different from your expected price. This phenomenon occurs especially when the market moves quickly and liquidity decreases. Slippage can lead to significant losses, especially if the market direction is against your expectations.

- Increase in spread (Spread): The spread is the difference between the purchase price and the sale price of an asset. At the time of publishing important news, due to the sudden increase in trading volume and extreme price fluctuations, brokers usually increase the spread. This issue makes traders face problems and increases the cost of trading.

-

Liquidity risks

- Reduced liquidity: At the time of important news, many traders may exit the market or reduce their activities to avoid sudden risks. This issue can reduce liquidity.

- Problems in execution of orders: At the time of news release, transactions may not be executed properly due to lack of liquidity or high traffic.

-

Reducing the effectiveness of trading strategies and tools

- Inefficiency of technical analysis: Technical analysis works based on past patterns and data of the market and can usually predict trends and entry and exit points well in normal market conditions. But at the time of news release, the market may react in such a way that it completely deviates from these patterns. The extreme volatility of the market at the time of news release makes technical analysis signals mostly unreliable.

- Failure of risk management tools to function properly: due to rapid price changes, risk management tools may not be able to be activated on time or be executed at the level desired by the trader. In addition, price chatter caused by news can cause the stop loss to be implemented at much more unfavorable prices, which makes risk management ineffective.

-

Psychology and stress

- Increased stress: The trading time of the news can create a lot of psychological pressure for the trader, especially if there is a lot of volatility in the market.

- Hasty decisions: In volatile market conditions when news is released, you may make hasty and irrational decisions that can lead to huge losses.

-

Lack of correct prediction of market movements

- Unpredictable market movements: Even if you have an accurate analysis of the impact of news on the market, the market may move against your expectations. Price fluctuations at the time of news release are usually unpredictable and even the smallest news can cause big changes in the market.

- Emotional behavior of traders: At the time of news release, many traders experience emotional behavior, which can cause irrational and irregular movements in the market.

Necessary recommendations for traders to avoid the dangers of news trade time

- Route Planning: Plan your trading route before entering trades. This planning includes predicting possible market reactions to the news, determining the exact entry and exit points for transactions, and considering the necessary measures in case the market moves in the opposite direction of your expectations.

- Risk management: The importance of risk management in time trading is very high. The use of risk management tools, limit orders and determining the appropriate volume of trades help traders to avoid large losses.

- Use of fundamental and technical analysis: simultaneous application of technical and fundamental analysis helps traders to make more informed trading decisions and avoid trading risks during these periods when important news is published. Before releasing the news, use fundamental analysis to check its possible effects on the market. Also, using technical analysis can help you correctly recognize price patterns and entry and exit signals.

- Use of pending orders: When important news is pending, the use of pending orders can help traders to avoid extreme market risks and fluctuations. If you place pending orders at certain price levels, you can automatically enter or exit trades when the price reaches it.

- Market Monitoring: Continuously monitor market changes as news releases. Pay attention to price fluctuations, trading volume and technical charts. If you witness sudden and unpredictable changes in the market, it is recommended to refrain from trading to avoid increasing risks.

- Continuous learning: Being aware of market developments and news allows you to make more effective decisions. Also, continuously improving your experience and learning from past mistakes will help you make the best decisions in the face of sudden market changes and news.

final word

In the end, trading on the news can be a profitable opportunity, but it also comes with high risks. In order to succeed in news trading, it is essential that traders enter the market fully prepared. By adopting a thoughtful and careful approach, you can navigate the turbulence caused by news in the market and make the most of the opportunities available in the market.