Getting capital for trade

Trading in financial markets is one of the most attractive and profitable ways to earn money and profit. Traders can earn very good income by investing and trading in financial markets. But one of the main challenges of traders, especially traders who are at the beginning of the path, has always been the provision and acquisition of capital for trading. If you are at the beginning of your trading journey, you must have faced the question, how can I receive capital for trading in the market?

In response, we must say that there are many ways to do this, if you are qualified and have the right skills to get capital for trading, you can easily get capital for your transactions. In this article, we will examine the various ways through which the initial capital for trade can be provided, the skills needed to obtain capital for trade, and introduce some services that provide trade capital. Stay with us in the future.

Why do we need capital for trading?

Increasing the capacity and volume of transactions

Better risk management ability

Expanding the range of investments

Taking advantage of more opportunities in the market

In the following, we will examine different methods of providing and obtaining capital for trading.

The best ways to get capital for trading

Use of personal capital

Getting a bank loan

Receive capital from prop form

Use of personal capital

The easiest and most accessible way to finance the initial trade capital is to use personal savings. In this way, you can start your activity in the financial markets without borrowing or committing to others or sharing the profits of your transactions with others.

Advantages of using personal capital in trading

Complete independence in decision-making: by using personal capital, you will have complete control over your capital and transactions, and you will be free in your decisions. This freedom of action allows you to implement your trading strategies without restrictions and have full control over your transactions.

Not sharing profits with others: When you enter into transactions with your personal capital, you will not need to share profits with any person or company. And all profits from successful transactions will be yours.

Disadvantages of using personal capital in trading

Need for significant savings: To enter the financial markets and make effective transactions, you need to have enough capital to be able to take enough risks and take advantage of trading opportunities in the market. Your initial capital may be limited and you may not have enough capital to carry out transactions.

High risk of losing the entire capital: In this method, you will lose all your capital if the trades are associated with losses.

High psychological pressure: When you use your personal capital for trading, the risk of capital loss can put a lot of psychological pressure on you. Especially if this capital is set aside for important purposes such as buying property or other things.

Lack of access to more capital: By relying on personal capital, you may face limits on the amount of capital you can allocate to trades. This limitation causes the loss of more profitable and bigger opportunities, and the trader will not be able to fully exploit the opportunities and potential of the market.

Getting a bank loan

In this method, you borrow a certain amount of money from a bank or financial institution and promise to repay it with interest within a certain period of time. Taking a loan to start trading has advantages such as quick access to capital and the possibility of entering into larger transactions with significant amounts, but at the same time, it comes with serious risks. If your transactions are not profitable, you will not be able to repay the loan and its interest; This issue will create a lot of financial pressure for you. Getting a bank loan to start trading requires careful consideration of the conditions and smart financial management to avoid these problems.

Advantages of taking a bank loan to start trading

Quick access to capital: One of the most important advantages of taking a bank loan to start trading is quick access to capital. With this capital, you can start your transactions and invest in different financial markets.

Increase the volume of transactions: By having more capital through taking a loan, you can enter into larger transactions and earn more profit. Of course, increasing the volume of transactions also means increasing the amount of risk and should be done with caution and using risk management tools.

No need to use personal capital: By using a bank loan, you can save your personal capital for other more important needs. With this, you can operate in the financial markets without risking your assets and personal savings.

Disadvantages of taking a bank loan to start trading

High financial risk: trading in financial markets is a risky activity in itself; Because these markets are always accompanied by extreme fluctuations and are unpredictable. When you use a bank loan to enter into transactions, your financial risks increase dramatically. In case of unsuccessful transactions, you not only lose your capital, but you are required to repay the loan and its interest.

Interest and financial obligations: When you receive a bank loan, you are required to pay interest in addition to the principal amount of the loan. This interest can be calculated monthly or annually, which will be a significant amount in the long run.

High psychological pressure: One of the disadvantages of taking a loan seriously to start transactions is the high psychological pressure it puts on a person. When you take a loan, in addition to the stress of transactions and the market, you also have to worry about repaying the loan. Especially when the market moves against your will and the transactions are accompanied by losses, this pressure and stress will multiply.

Receive capital from prop form

One of the best methods of providing capital for trading is trading as a prop trading and using the services of prop form companies. Prop-form companies provide the capital needed by professional traders to trade with that capital. In this model, as a professional trader, you enter into a contract with a prop-form company and trade with their capital; In return for receiving the capital, a percentage of the profit of the trader’s transactions will be given to the prop-form company. Prop-forms often evaluate traders’ trading skills and profitability before granting capital.

These evaluations usually include trial trades in real market conditions that allow the company to know the trader’s skills and abilities. After overcoming the challenges of evaluation and proving your trading skills to the prop-form company, real capital will be available to you and you will be able to enter the market. This method is suitable for traders who have enough skills to trade in the market and earn profit, but do not have enough capital to enter into transactions.

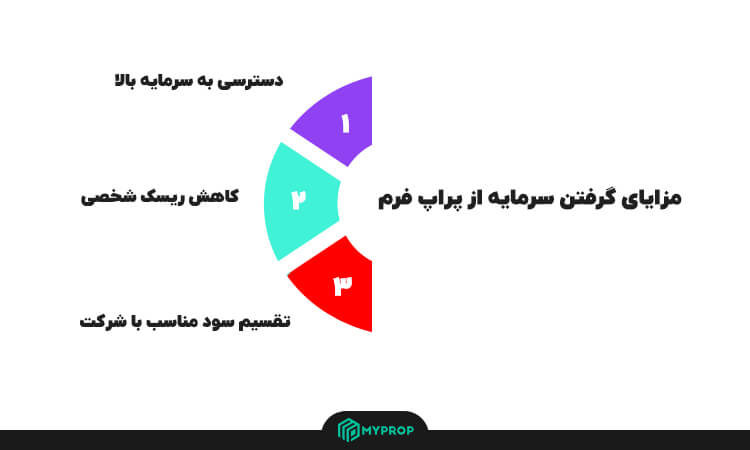

Advantages of using prop form

Access to high capital: one of the biggest advantages of prop-form is receiving significant capital to start trading; This high capital allows the trader to enter into larger and higher volume transactions and benefit from more profitable opportunities.

Reduction of personal risk: in prop trading, the trader enters into transactions with the capital of the company, and as a result, the risk of losing personal capital is minimized.

Appropriate profit sharing with the company: When you receive capital from prop-form companies to enter into transactions, the profit from the transactions will be divided between you and the prop-form company in a certain ratio; This profit distribution is usually in such a way that you get a significant share of it and the prop-form company receives only a percentage of the profit.

Disadvantages of using prop form

Trading rules and restrictions: one of the main disadvantages of receiving capital from prop forms is the existence of restrictions and strict rules in transactions; These restrictions are usually applied in order to manage risk and preserve the capital of the company, but they can limit the trader’s flexibility in trading decisions and implementing strategies.

Strict evaluation procedures: The purpose of evaluation procedures for prop-form companies is to ensure the trader’s trading skills, the trader’s ability to earn stable profits and risk management. Since prop-forms provide a lot of capital to traders, they look for people with the highest skills and experience. Passing these entry tests can be challenging for new traders.

Constant pressure to maintain positive performance: Traders who work with prop-form capital must always show good performance in trading and have reasonable risk and return; In addition to focusing on trading and trading strategies, these traders must always think about maintaining the performance criteria set by the prop form.

In the following, we will examine the important points of obtaining capital for trading through prop forms.

Important tips for getting capital for trading

In the past, getting capital to trade was a big challenge. Because traders had to look for investors on their own, and investors had no way to evaluate traders’ trading skills. But today, with prop trading companies, the path of getting capital for trading has become much smoother. By providing a suitable platform, prop-form companies allow professional traders to trade in the financial markets using their capital and earn huge profits.

Familiarity with financial markets

In order to be able to receive capital from prop forms and operate as a professional trader in the market, it is very important to have a deep knowledge of the financial markets. This knowledge and awareness includes a deep understanding of the behavior and fluctuations of markets such as Forex. Traders should know well what factors affect prices and how they can predict these changes. In-depth knowledge of the market helps traders to make better decisions in the face of different market conditions and to act successfully in the stages of challenging and evaluating prop-form companies.

Familiarity with technical analysis and fundamental analysis

Technical analysis helps traders in using various charts, patterns and indicators, analyzing price movements and identifying suitable points for entering and exiting trades. On the other hand, fundamental analysis includes the examination of financial and news factors that can affect the value of assets; These factors include economic reports, central bank policies and companies’ performance. Mastering these two types of analysis will help traders make informed and successful trading decisions.

Have risk management and capital management

The ability to manage capital and manage risk in prop trading helps traders to avoid heavy losses by determining the appropriate size for each transaction and allocating a certain percentage of capital in each transaction. Risk management using tools such as stop loss and profit limit allows you to control the risk of your trades and protect your profit. Your ability in these two areas shows responsibility and accuracy in decision-making, and it is necessary and necessary not only in prop form but in any other trading method.

Have a tested strategy

Propforms are looking for traders who can use a proven and reliable trading strategy to have a stable performance in the financial markets; This strategy should be tested on historical data in sufficient periods of time to prove its effectiveness and profitability. Having a tested strategy will help you take on the challenges of prop trading evaluation with more confidence and improve your performance.

The best prop trading for Iranians should have the following conditions:

High reputation and history

Providing services to Iranians without geographical restrictions

Has various payment methods

Transparency in the rules

Providing various tools and platforms

Fair profit sharing percentage

Providing appropriate training and support

Myprop prop trading platform

MyProp is one of the popular prop trading platforms in Iran, which gives professional traders the opportunity to participate in financial markets by getting capital for trading from this platform. By providing comprehensive and transparent services, and by allocating capital to traders, MyProp allows them to implement their strategies in a supportive environment without risking personal capital. By becoming a member of MyProp and using its PropTrading services, you can work as a professional trader and benefit from big profits in the financial markets.